How does it work?

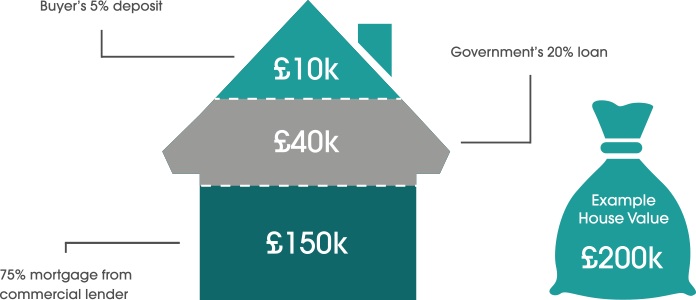

The Government Help to Buy Equity Loan scheme is open to both first time buyers and existing homeowners for the purchase of a New Home with a purchase price of £600,000 or less. With a Help to Buy equity loan the Government lends you up to 20% of the cost of your new-build home, so you’ll only need a 5% cash deposit and a 75% mortgage to make up the rest. You won’t be charged loan fees on the 20% loan for the first five years of owning your home.

Example: for a home with a £200,000 price tag

You buy 100% of a brand new home from a developer who is registered for the scheme. You fund 80% of the purchase through a combination of a mortgage and your deposit; the remaining 20% is covered by an ‘equity loan’ from the government. This loan is interest free for the first five years. From year six, you’ll start paying a monthly fee on the equity loan. These are fees on the loan, not repayments of the loan itself.

Your mortgage and deposit: You must have a mortgage to be able to buy using the Help to Buy Equity Loan scheme as the equity loan has to be registered as a second charge against the mortgage. You will need a minimum 5% deposit, along with a 75% mortgage, but you can put in a higher deposit to reduce your mortgage if you wish. The minimum mortgage level acceptable under this scheme is 25% of the full purchase price.

How do you apply for a Help to Buy loan?

We will introduce you to a mortgage advisor who can explain in more detail how the scheme works and who will submit your application for you, or you can of course find and use your own mortgage advisor.

Please note the following strict restrictions:

•At present part exchange is not available if you use the Help to Buy Equity Loan scheme

•You cannot own two properties at the same time under the Help to Buy Equity Loan scheme

•You will need to be able to get a mortgage to buy through the Help to Buy Equity Loan scheme

To find out more about the steps involved in buying a new house see our House Buying Process page.

Repaying your Help to Buy Equity Loan

You can repay your Help to Buy Equity Loan any time up to 25 years after you took it out. If you haven’t paid it back before, you must pay it back after 25 years. If you move, you will need to repay your loan at that point. You cannot transfer an existing loan to a new property. If you redeem your mortgage, the equity loan will have to be paid back at the same time.

The amount you repay is linked to the value of your property. If you took out a 20% equity loan, the amount you pay back will be 20% of the current value of your property. So if the value of your homes goes up, the amount you pay back, also goes up. If the value of your home goes down, the amount you pay back also goes down, so you are protected if property prices fall after you buy.

Your Help to Buy Equity Loan will be interest free for the first five years; from year six a fee of 1.75% applies which increases annually by RPI plus 1%. Please note that these payments are a fee on the loan – they are not repayments of the loan itself.

.